When it comes to international trade, especially in materials like PP master batch, getting the details right is crucial. One key detail? The HS code. But what is an HS code, and why is it important for PP master batch? Let's break it down, step by step, so you can navigate these codes with confidence and avoid costly trade errors.

What Are HS Codes?

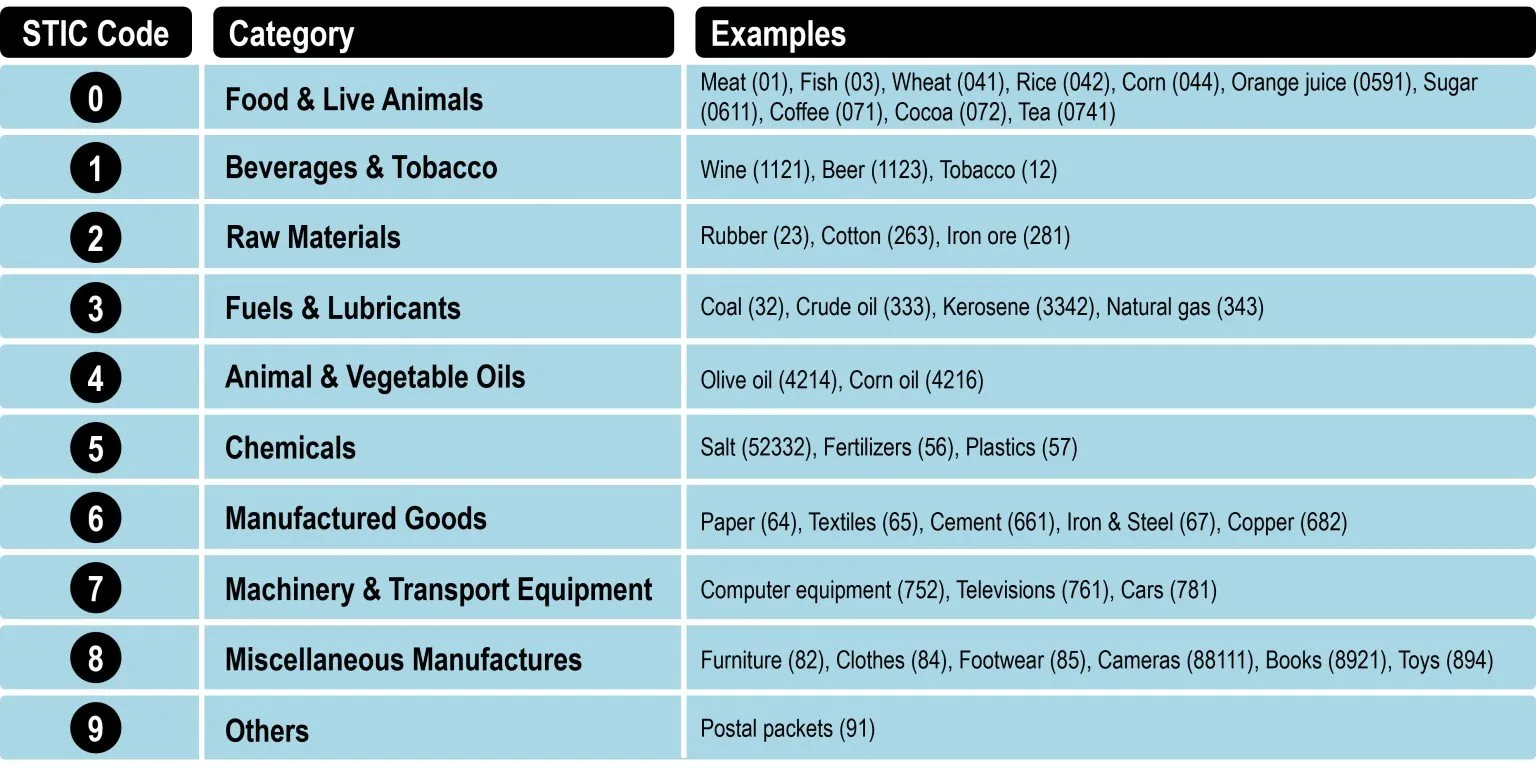

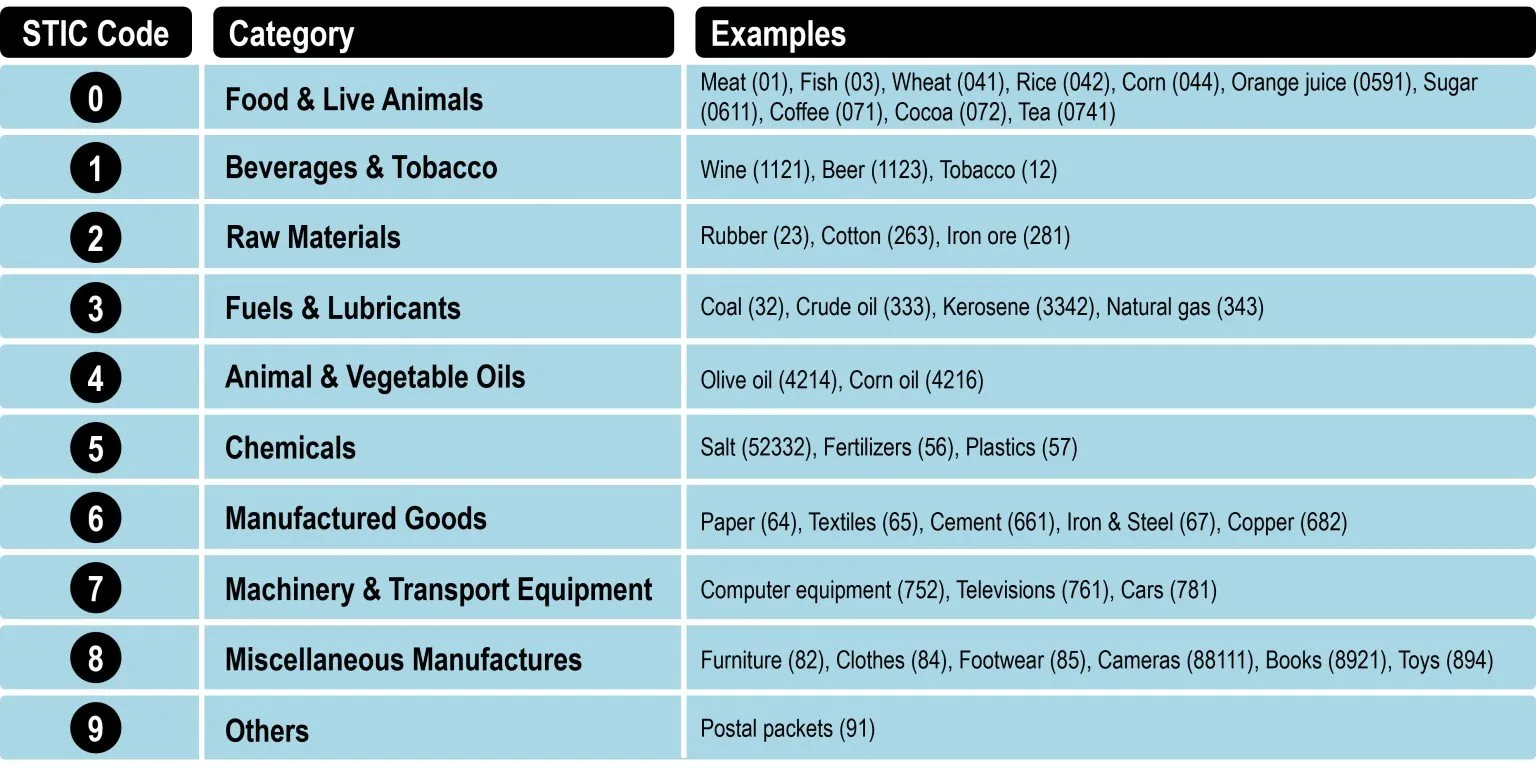

HS (Harmonized System) codes are standardized numerical codes used worldwide to classify goods in international trade. Created by the World Customs Organization (WCO), HS codes allow for a common language across borders, ensuring everyone understands what’s being traded, regardless of language or local customs.

Why HS Codes Matter in International Trade

HS codes are more than just numbers—they are critical for determining tariffs, managing customs clearances, and avoiding penalties. Imagine sending your PP master batch overseas, only to have it held at customs because of an incorrect HS code. That's costly and time-consuming!

Understanding PP Master Batch

What Is PP Master Batch?

PP (Polypropylene) master batch is a highly concentrated blend of pigments and additives encapsulated into a carrier resin, often used in plastic manufacturing to add color or improve product performance.

Why Is PP Master Batch Important?

PP master batch is invaluable in industries where precision and quality matter, like packaging, automotive, and construction. By adding specific properties or colors to polypropylene, manufacturers can enhance durability, UV resistance, or simply the aesthetic appeal of products.

Common Uses of PP Master Batch in Various Industries

From creating durable plastic containers to crafting components in automobiles, PP master batch is a versatile material. It can be found in everything from kitchenware to heavy-duty construction materials, proving its wide-ranging importance in manufacturing.

HS Codes Explained

The Purpose of HS Codes in Global Trade

HS codes provide a universal framework that streamlines trade across borders. They allow customs officials to quickly understand product categories, applying appropriate taxes and adhering to regulatory requirements.

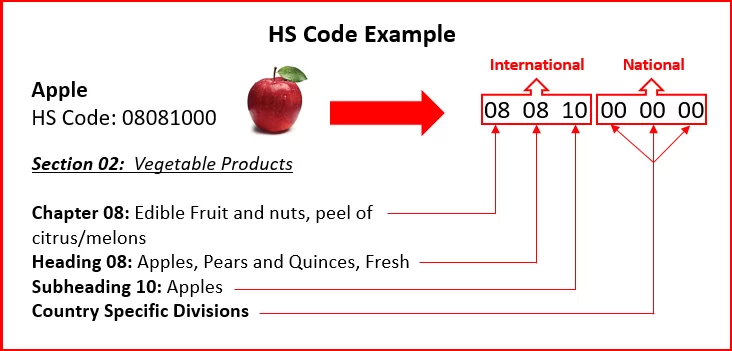

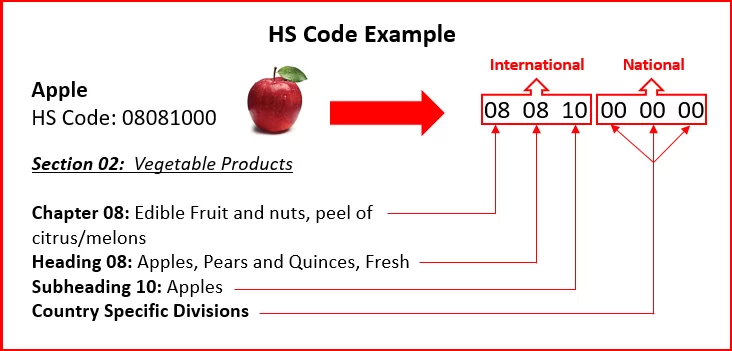

Structure of an HS Code

HS codes are structured into six-digit codes, but countries can add extra digits to customize them. The first two digits represent the chapter, the next two define the heading, and the last two clarify the subheading. This layered system keeps the classification precise.

Who Creates and Regulates HS Codes?

The World Customs Organization (WCO) is responsible for the Harmonized System and regularly updates it to reflect changes in global trade practices. National customs authorities also interpret these codes, which may lead to regional variations.

HS Code for PP Master Batch

Identifying the Right HS Code for PP Master Batch

Finding the exact HS code for PP master batch is not always straightforward. Depending on the product's composition and intended use, the code may vary. PP master batch often falls under Chapter 39, which is dedicated to plastics and articles thereof.

Differences Between HS Codes for Similar Products

HS codes differentiate between raw materials, semi-finished, and finished goods. While PP master batch is considered a semi-finished product, the classification may differ from raw polypropylene resins.

Where to Find Reliable HS Code Information

Reliable HS code information can be found on official government or customs websites, or through the WCO’s online database. It’s essential to verify codes from trustworthy sources to avoid mistakes in classification.

HS Code Classification Process

Factors That Influence HS Code Classification

The HS code for a product like PP master batch depends on factors like material composition, intended function, and even the manufacturing process. These specifics can lead to different HS codes for seemingly similar items.

The Role of Product Composition in HS Code Assignment

For products with varied ingredients, like PP master batch, classification may hinge on the dominant component. Customs officials might assign different codes based on whether it’s a pigment-heavy mix or a UV-resistant formulation.

Understanding the Harmonized System's Hierarchical Structure

The HS code structure, from chapters to subheadings, ensures that each product has a clear place in the international classification system. This hierarchy helps prevent confusion in identifying products and applying tariffs.

How to Determine the HS Code for PP Master Batch

Researching Through Government Websites

Many government trade and customs websites offer HS code search tools. Checking these sites is a good starting point for ensuring your PP master batch is correctly classified.

Using Online HS Code Directories and Tools

Platforms like the WCO’s Harmonized System database or dedicated trade platforms provide comprehensive HS code directories, often searchable by product type, making it easier to pinpoint the correct code.

Consulting Trade Specialists or Customs Brokers

For complex classifications, consulting a customs broker or trade specialist can provide clarity. These experts can ensure your HS code selection aligns with current trade regulations.

Importance of Correct HS Code Use

Avoiding Delays and Penalties in Shipping

Incorrect HS codes can lead to costly delays, as customs may detain shipments for reclassification. In worst cases, penalties or fines can be imposed.

Ensuring Compliance with International Trade Regulations

HS codes aren't just about classification—they’re key to regulatory compliance. Failing to use the correct code could mean breaching trade laws, which can carry serious consequences.

Impact on Tariffs and Import/Export Costs

The HS code directly influences the tariff rate applied to goods. Incorrect classification can lead to unexpected costs, impacting the bottom line for both importers and exporters.

Common HS Code for PP Master Batch

Typical HS Code for PP Master Batch and Related Products

The HS code for PP master batch often falls within 39.19, but exact codes may vary by region. Always verify with the latest data from customs authorities.

Differences Between Raw PP Materials and PP Master Batch Codes

Raw polypropylene and PP master batch may seem similar, but they often have distinct HS codes due to differences in processing and use.

Examples of PP Master Batch Codes in Various Countries

In the US, the code might be slightly different than in the EU, even though the overarching category (Chapter 39) remains the same. Regional adaptations in codes can occur, so checking local databases is essential.

Variations in HS Codes by Region

Why HS Codes Can Differ by Country

Though based on the same system, countries can add digits or sub-categories, creating slight regional variations. Understanding these can prevent misclassification in foreign trade.

Key Regional Variations in HS Codes for PP Master Batch

For instance, the EU might classify PP master batch differently than Asia, reflecting unique regional standards or requirements.

How HS Codes Impact Trade and Tariffs

Tariff Calculation Based on HS Codes

Tariffs are calculated based on HS codes, so using the correct one is vital to understanding the full cost of shipping and handling.

Influence of HS Codes on Customs Clearance

HS codes expedite customs processes by providing clear, universal product definitions, minimizing misunderstandings at borders.

HS Codes and Trade Agreements

HS codes play a role in trade agreements, affecting tariff rates and eligibility for preferential treatment, such as reduced taxes.

Conclusion

Accurately classifying your PP master batch with the correct HS code ensures smooth trading, from tariffs to compliance. By understanding the basics and using reliable resources, you can avoid pitfalls and trade with confidence.

English

English